For small business owners, securing the capital needed to grow can often feel like an uphill battle. However, as Brandon Kochkodin reports in Forbes, a new wave of lending programs is opening up nearly unlimited funding opportunities for entrepreneurs looking to scale their businesses. With a focus on providing more flexible and accessible financing options, these programs are reshaping the landscape for small businesses nationwide.

A New Era for Business Financing

Traditional lending institutions have long posed challenges for small business owners, often requiring extensive credit history or demanding collateral that many early-stage businesses simply cannot provide. The new funding options highlighted by Kochkodin cater specifically to small and medium-sized enterprises (SMEs), offering lines of credit and loans without the stringent requirements of traditional banks.

These programs, often spearheaded by financial technology (fintech) firms, provide quick access to capital with more lenient qualifications, giving business owners the flexibility to invest in growth opportunities when they arise. Additionally, these lending platforms utilize advanced algorithms to assess business health, making it easier for companies to get approved for financing.

Key Benefits of These Lending Programs

- Increased Access to Capital: Many of these platforms offer nearly unlimited funding, meaning that as long as your business meets certain financial health metrics, you can continually access new loans or lines of credit.

- Fast Approvals: Unlike traditional banks, which often take weeks to process loan applications, fintech lenders can approve loans in a matter of days or even hours. This rapid access to funding can be crucial for businesses needing to act quickly on opportunities.

- No Collateral Requirements: Many of these new-age lenders do not require collateral, making it easier for small business owners to secure financing without risking personal or business assets.

- Flexible Repayment Terms: The programs tend to offer flexible repayment schedules, allowing businesses to pay back loans based on cash flow, which is a huge relief for companies with fluctuating revenues.

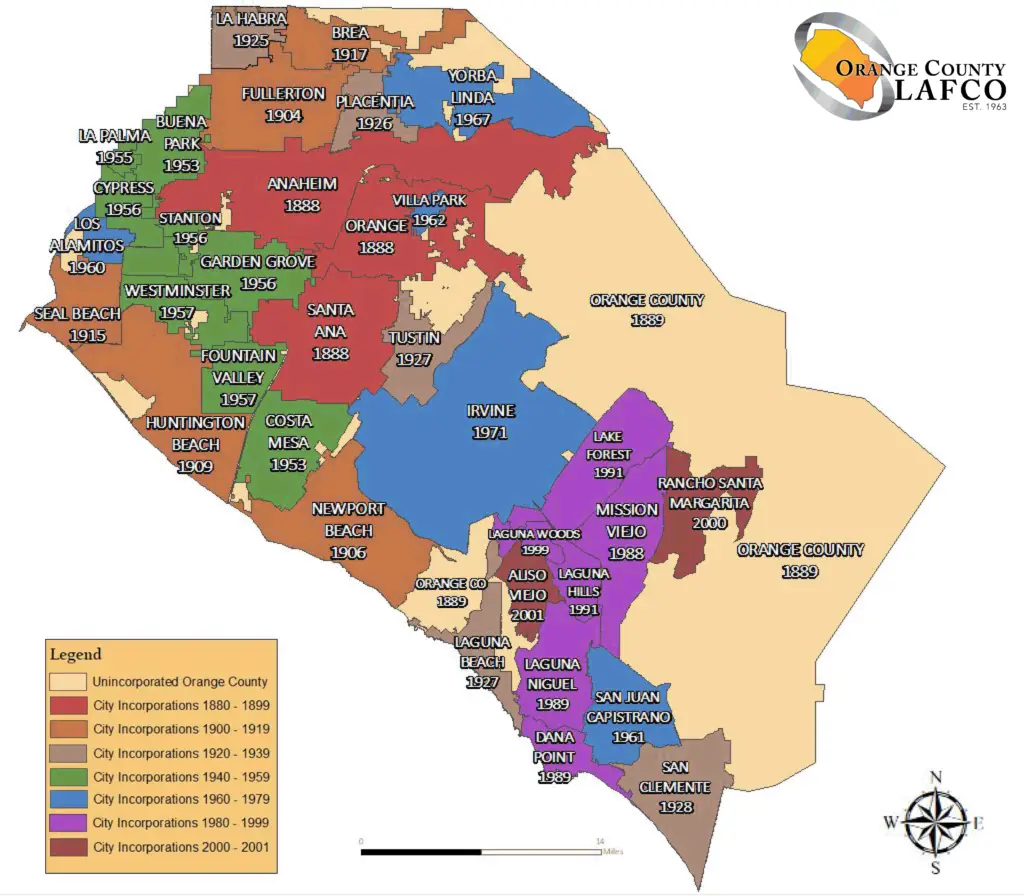

How Small Businesses in Orange County Can Benefit

Orange County, a hub for entrepreneurs and growing small businesses, stands to gain significantly from these emerging financing options. Local businesses across sectors like tech, retail, and hospitality can leverage these loans to expand operations, invest in new technology, or open additional locations.

Moreover, the flexibility of these programs aligns perfectly with the dynamic nature of business in Southern California, where rapid shifts in consumer demand can create both challenges and opportunities. By securing fast, accessible funding, Orange County business owners can stay competitive in this fast-paced market.

The Bigger Picture

Kochkodin’s article underscores a broader trend: the democratization of business financing. These new lending models are designed with inclusivity in mind, providing opportunities for underrepresented and smaller-scale entrepreneurs who may have been overlooked by traditional lenders. As these programs continue to grow, they could reshape how small businesses think about funding and expansion.

For those looking to build their small business empire, this new era of nearly unlimited funding offers a path forward, making the dream of scaling up more achievable than ever before.

You can read the full Forbes article here.